After being somewhat eclipsed from the news, Bitcoin is making a strong comeback in the news. Crossing the €40,000 mark, an unprecedented performance in a year and a half, this resurgence is perhaps not fortuitous. At the dawn of 2024, a major event is indeed planned: the Bitcoin halving, which enthusiasts are eagerly awaiting!

The arrival of the halving?

The “halving” is an automatic event in the Bitcoin network that occurs every four years and has the effect of reducing the rewards allocated to miners by half. This reduction creates a supply shock, because it reduces the quantity of new bitcoins created. Historically, this has always been followed by a significant increase in the value of Bitcoin due to its new relative scarcity, as can be seen here:

Bitcoin is indeed gaining value partly due to its limited supply of 21 million coins, which creates scarcity. Conversely, fiat currencies like the euro or the dollar can be printed in unlimited quantities by central banks, which can lead to inflation when too much money is put into circulation relative to the value of available goods and services. This inflation can decrease the value of the currency. This is what we have been experiencing since the Covid crisis, during which countries have been printing money left, right and centre. Bitcoin, with its hard cap, is designed to avoid this devaluation problem, which can increase its value over time as demand for a limited resource continues to grow.

Bitcoin ETF and safe haven

In addition, the recent rise of Bitcoin can be explained by several other factors. The announcement of a first Bitcoin ETF (exchange-traded investment fund) on Wall Street is a sign that traditional financial markets are increasingly opening up to cryptocurrencies. This integration increases legitimacy and could attract new institutional investors. Thanks to this ETF, it will indeed be possible to benefit from the performance of Bitcoin, without even having to own cryptocurrency!

Furthermore, in a climate of sustained global inflation, Bitcoin is increasingly perceived as a haven of financial stability, reinforcing its status as a “safe haven”, just like gold for example.

As we can see, the price of Bitcoin has increased by 160% over the past year! However, it has not yet reached its highest point, reached at more than $69,000 in November 2021. And the next halving should easily surpass this record.

DCA: the method to not miss the train

The Dollar-Cost Averaging (DCA) strategy turns out to be a prudent investment technique, particularly in the volatile context of cryptocurrencies. DCA consists of regularly investing a fixed amount in an asset, regardless of its price. This allows investors to reduce the impact of volatility on their purchases.

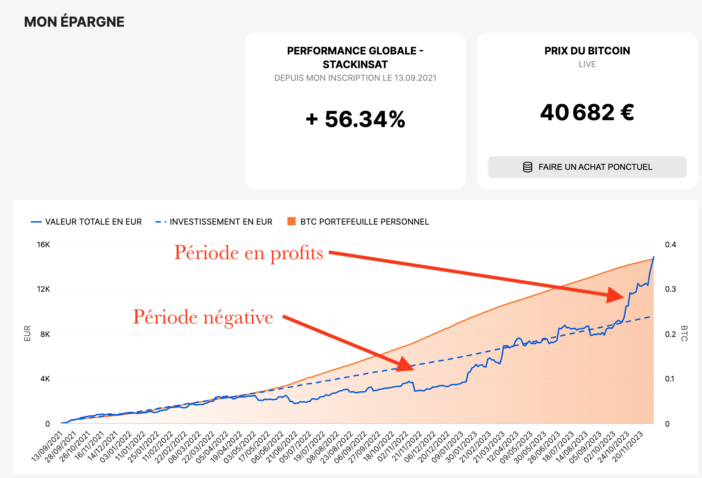

We had the opportunity to discover this technique two years ago, notably with StackinSat, which offered the “Bitcoin Savings Account”. A service that I have been using myself for two years, and that I really appreciate for its simplicity: once the transfer is programmed each week or month, the company takes care of everything automatically to make us accumulate Bitcoin. An investment that is completely forgotten. If for a while the portfolio had found itself in the negative due to the fall of Bitcoin, the recent increase in the price of BTC has given it a new lease of life:

Over two years, those who applied DCA to Bitcoin were able to mitigate the risks of price fluctuations while positioning themselves advantageously before the halving of 2024!

We had also seen the possibility of rounding up all our expenses paid by credit card, to accumulate Bitcoin, thanks to the BitStackservice. A kind of painless DCA, practiced for each of our daily expenses. Here, €600 rounded up over 2 years, or about €5.5/week automatically invested in Bitcoin, which have increased by 100%, to give more than €1200 to date. Nice! And this is only the beginning of the increase ;-)

Or the investment with CryptoSimple, which was responsible for designing a balanced portfolio, based on Bitcoin, but also other cryptocurrencies. The CryptoSimple portfolio has “only” increased by 59% here, but because it is made up of Bitcoin, Ethereum, and various other cryptos selected by the managers.

In short, there is no shortage of ways to easily invest in Bitcoin!

Conclusion

With Bitcoin’s halving on the horizon, those who have wisely invested via DCA could find themselves in a very enviable position in the coming months. The planned reduction in Bitcoin’s supply could propel its price to unprecedented levels, making this period a potentially historic moment for savvy investors and cryptocurrency market observers. And you, did you jump on the bandwagon during our various presentations?

Please remain courteous: a hello and a thank you cost nothing! We're here to exchange ideas in a constructive way. Trolls will be deleted.