For a little over two years now, I've been very interested in trading. As we've seen in previous articles, even without knowing how to trade yourself, it's entirely possible to rely on companies that do it for you, or even simply by copying other traders automatically. This is called “Copy Trading.” But it's also possible to install a trading robot yourself. This has many advantages: first, you're completely independent and manage the robot as you wish; second, the profits are entirely yours, without having to pay anything to a company or trader. Especially since it's not so difficult to set up after all! To begin: a little vocabularyTrading is a very specific field, with its own vocabulary. Without needing to know all the terms, there are a few basics to know:

Trading:

Trading is an English word commonly used in France to refer to buying and selling transactions carried out on financial markets: stocks, financial options, futures contracts, currencies, indices, etc. The goal, of course, is to buy low and sell higher, thus making a capital gain, particularly through leverage. These transactions are called “trades,” and the person executing them is a “trader.” Anyone can be a trader: you and me. Although it's preferable to train beforehand, no training or diploma is required to be a trader. Anyone can buy a stock today and sell it tomorrow, but you can also buy a currency like the ruble or the dollar, or even gold, etc.

- Broker: The Broker is responsible for executing the trader's orders. It is an intermediary authorized to carry out these transactions on the financial markets. It is a financial entity accredited to carry out transactions on the financial markets. Your bank can, for example, act as a broker when you ask your advisor to buy a few shares of a company.

- Metatrader: This is the most commonly used software for placing trades. Free and available on many platforms, it allows you to have a graphical representation of the market, perform your own analyses, and place orders. We commonly refer to MT4 for Metatrader version 4, and MT5 for version 5. Robot, Bot, EA, or Expert: Different terms for a trading robot, i.e., a program that analyzes the market and places trades itself based on its algorithms. Sell: This is a short trade. A Sell order is placed when the market is expected to decline.

- Buy: Conversely, this is a long trade, used when the market is expected to rise.Take Profit (TP): This is the profit you want to make. By setting a TP, the trade automatically closes when this level is reached, thus taking the profit.

- Stop Loss (SL): This is the maximum loss you are willing to accept. If the trade goes in the opposite direction of what you expected, and generates a loss instead of a profit, the SL allows you to “take your loss” before it gets even worse. Taking a loss is part of trading; you can't win every trade.

- Trailing Stop: This is a slightly more complex concept, but very useful in this area. It's basically a rolling stop loss, which allows you to lock in profits. If, for example, we have a trade placed at 10, with a stop loss at 8, and the trade rises to 13, the trailing stop can automatically be positioned at 12, for example. So if the trade moves in the other direction, if it reaches 12, the stop loss will be hit and the trade closed. But still closed at a profit! Whereas if the stop loss had remained at 8, we could have taken a loss.

- Break Even (BE): This involves closing trades without loss or profit, hence the term break even. Sometimes the market situation can be more difficult than expected, and we then consider ourselves happy to cut everything at BE.

- Drawdawn (DD): This refers to the potential loss. During a trade, for example, the market may momentarily move in the opposite direction to what we had predicted. The Drawdawn may then display a -20%, for example. Closing the trade at that point would result in a 20% loss. But as long as the trade isn't closed, nothing is decided: the market may recover and allow the trade to ultimately close with a 10% profit. The DD must therefore be considered as an acceptable risk. For example, some strategies regularly have DDs of 70 to 80%, only to end up with profits of less than 5%. This is said to be a poor risk/reward ratio, because at any time, it's possible to lose 70 to 80% of your capital, only to end up with a 5% profit. The acceptable DD therefore depends directly on your risk tolerance.

- These terms will be used throughout the rest of this guide, so it's important to understand them. Prerequisites for installing a trading robot

- Open an account with a broker

- To begin, you'll of course need an account with a broker. There are many available. But it's important to choose a reputable and regulated one. The one I particularly like is Roboforex, for its quality and reliability. This broker, located in Belize, has been around for 13 years, with over a million clients, and is regulated by the FSC. You can find all the information about this broker on its dedicated page.

roboforex license

Copy Trading SDT, WSI, Meckie: or how to make up to 800% profits by following professional traders! 1

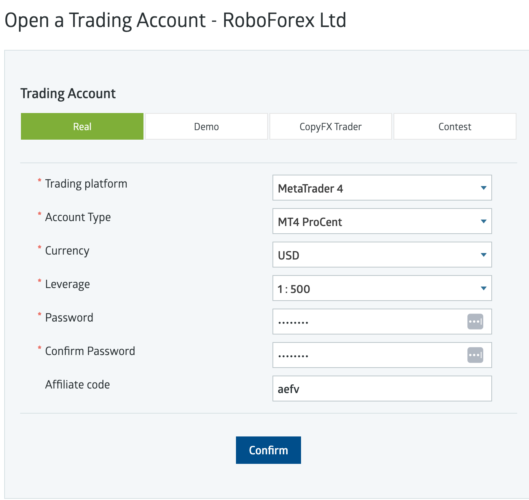

You will, of course, first need to open an account on the Roboforex website. The procedure is standard: account creation, KYC (i.e., submitting the necessary identity documents), then depositing funds, which can be done by wire transfer, credit card, or even cryptocurrency. Create a Roboforex Account

Note that a single Roboforex user account can host multiple Metatrader 4 (MT4) accounts, and therefore multiple trading bots if needed. For example, I have about ten trading accounts running in parallel on my account, whether for copy trading or my own trading bots. I simply create a new MT4 account each time. But since I don't like to put all my eggs in one basket, I also use the brokers VantageFX, which we've already seen with ACWin, for example, or VTMarket, which many traders appreciate for its reliability and sometimes more advantageous terms. The principle and possibilities are the same as with Roboforex.Create a VantageFX Account (code yyRFT7sY)

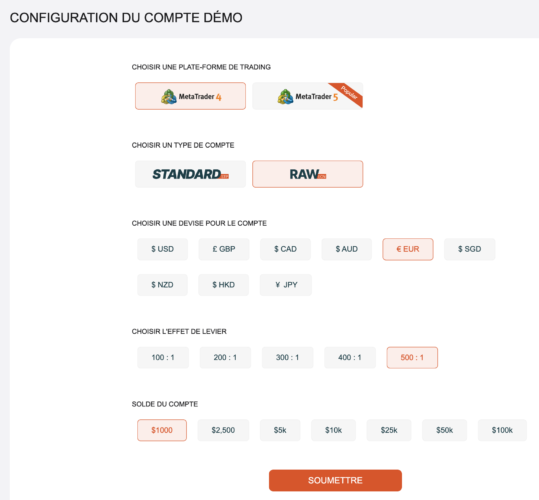

You then need to open an MT4 account. It's also possible to simply open a Demo account, with the balance you want, since this is completely fictitious money. This is a good solution for testing your trading robots without risking losing money. For example, here at VantageFX, I opened a Demo account in “Raw”, Euro currency, and leverage of 500:1, with €1,000. It's a Demo account, so it doesn't cost me anything at all; I could just as easily open an account with €100,000. Once the robot is well-established, you can open a live account, deposit money, and let the robot work on it. Find a Trading BotA trading bot is a program, in the form of one or more files, that is installed in Metatrader 4 (or 5), a software program used for trading. They come in all sorts of formats, and are available in many places, both free and paid:

ValeryTrading

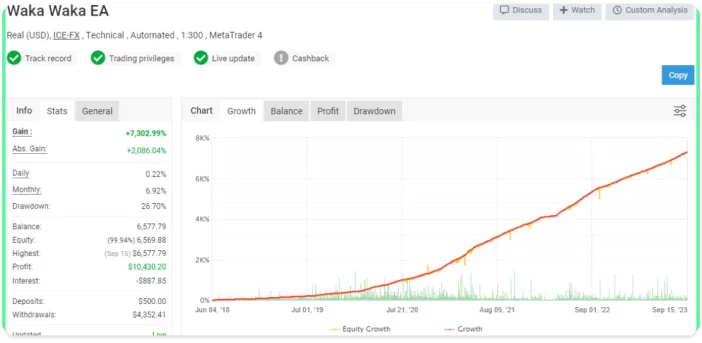

: She's a very well-known bot developer today. There are many bot developers out there, but Valery's often come to the forefront, as they are so powerful and effective. She currently offers five bots for different needs, but one of the best known is WakaWaka, which has achieved 7200% profit in five years! However, her bots are quite expensive, often approaching $2,000. Fortunately, it's possible to test them for free to get an idea. And since a bot can be used on 10 different accounts, the trick is often to buy it together. If some are interested, we can organize this here. FXCracked: A Telegram group for mutual support around trading bots. There are many shared bots and configuration tips. Metatrader EA Expert Advisor Robot: another Telegram group, this time in French. WakaWaka's results are quite incredible… This is of course not an exhaustive list; there are a huge number of places where you can find bots.Rent a VPS

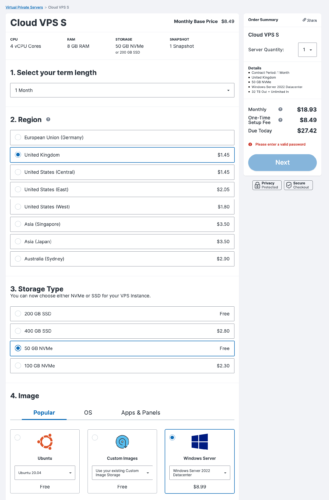

Some companies offer to choose the location of our VPS. The closer it is geographically to our broker's server, the lower the latency will be, and therefore the faster the trades will be placed. As mentioned above, even the slightest millisecond can have an impact on results. The VPS provider ensures that it is always operational, with a reliable internet connection. Here too, even the slightest internet outage preventing you from closing a trade, for example, can cost you dearly.

Again, there are many VPS providers. Standard web hosts like Infomaniak or OVH, for example, offer them. As long as they offer a VPS equipped with Windows and decent performance, it should be fine. However, these standard providers are mainly intended for traditional IT applications. There are VPS providers more suited to trading, such as Contabo, which I have been using for over a year. This German provider has data centers all over the world, allowing you to select a VPS in the location of your choice. Contabo has servers in strategic locations.

The Cloud VPS S, equipped with 4 vCPU Cores, 8GB of RAM, and 50GB of storage, is more than sufficient. It allows you to easily run 4 or 5 bots on the same server without any slowdowns.

When ordering, you can choose the geographic location: here, for example, I know that the Vantage account I'm using has its server in London. So I choose to place my Contabo VPS in the United Kingdom. You then need to select the desired operating system: here, a Windows Server, as the MT4 software works best under this operating system. There's an additional cost for using Windows, and installation costs. The first time you use this system, you'll have to pay $27. It will then be $18 per month, which is still very reasonable for this type of VPS, and it will be easy to make profitable with trading profits.

- When ordering, you also specify an administrator password that will be used to log in.Reserve a VPS from Contabo

- We now have everything you need to get started!Install a trading robot

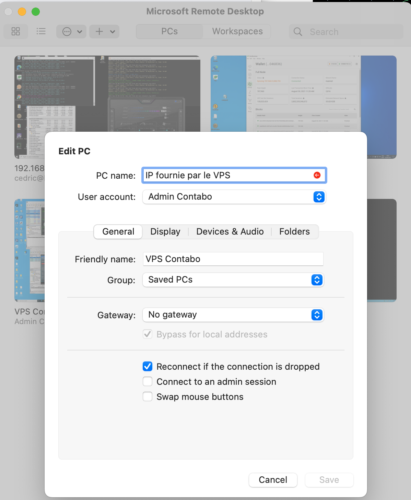

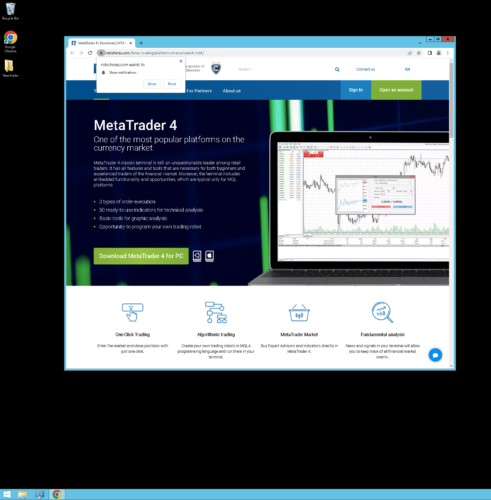

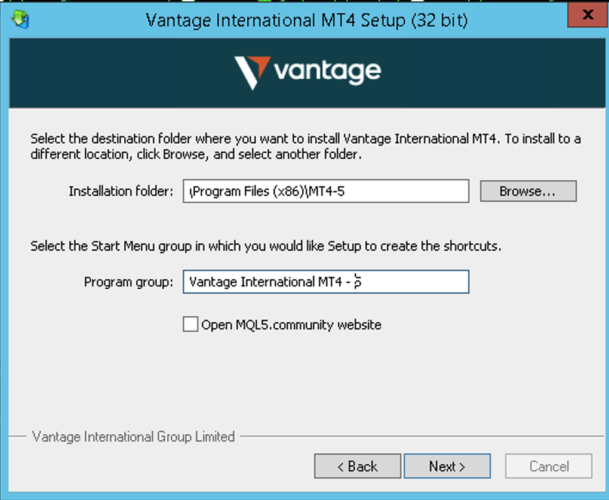

- If you've opted to rent a VPS, you'll need to connect to it, using Microsoft Remote Desktop software, for example. This application is available on most platforms (Windows, Mac, and even iOS and Android, which allows me to control my VPS from anywhere if needed when I'm traveling). You enter the IP address provided by Contabo, as well as the username and password.You confirm, log in, and in a few seconds, you'll be on the Windows desktop of the VPS in question. From then on, everything works just as if you were working on a regular Windows computer. You can then go to the chosen broker's website to download the Metatrader 4 software. Please note that each broker offers a customized version of this software, including its own servers. If you download the Vantage version, for example, you won't see the Roboforex servers during account setup.

- Metatrader is installed like any standard Windows application.When you launch it, you'll need to enter the account number, password, and server of the MT4 account you've created. All this information is sent to you by the broker:

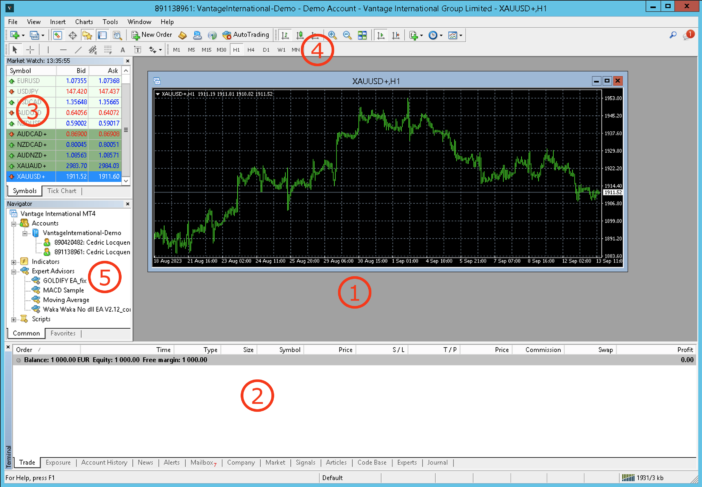

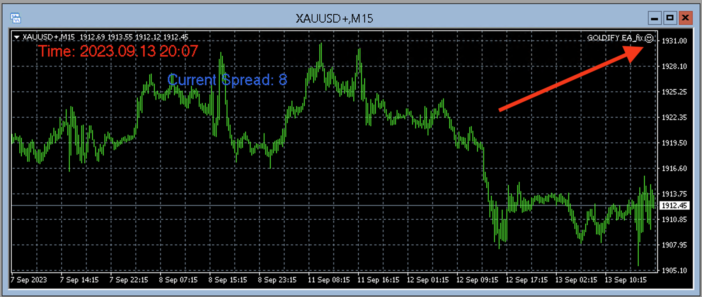

Section 1 displays the chart of the current pair you wish to trade, for example, the XAUUSD, which is gold (XAU) versus the dollar (USD). Experienced traders can add indicators, draw lines, and more in this section to fine-tune their strategy. Simply select the desired pair from Box 3 and drag it with the mouse to Section 1 to open the corresponding chart. It is possible to open multiple charts simultaneously.

Section 2 displays the account balance, as well as any open trades, including their direction, current profit or loss, and so on. If necessary, right-clicking on it allows you to modify or close a current trade (just like the cross that appears at the end of the line to quickly close a trade). Several tabs allow you to display different information in this section.

Box 3 displays the pairs being tracked. You can add symbols by right-clicking on “Symbols” and selecting the pair you want to add. There's no need to display large quantities, as the value of the pairs is constantly updated, which consumes computer resources. It's best to only display the ones you actually use.

- In box 4, we have various toolbars. Two elements are of particular interest to us: the “Autotrading” button, which must be enabled for the trading robot to function. When it is disabled, the robot is stopped. This is useful for pausing it whenever you want, for example, during economic announcements. Then, the M1, M15, M30, H1, etc. buttons allow you to set the “timeframe,” i.e., the chart's time scale. M1 for 1 minute, M15 for 15 minutes, etc. Some robots require a specific timeframe to function, since each timeframe can display different trends. For example, gold may be down for an hour, but up for the day overall.

- Finally, box 5 displays the current trading account, as well as the available indicators and robots.

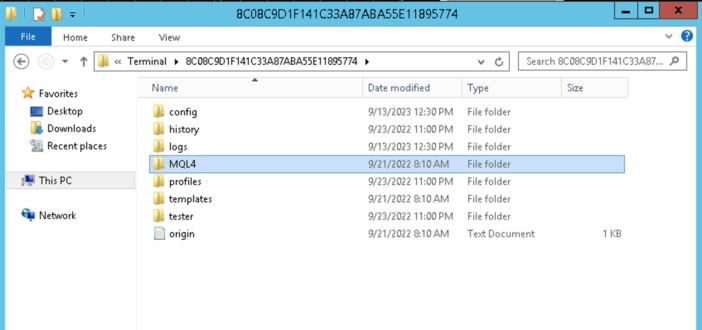

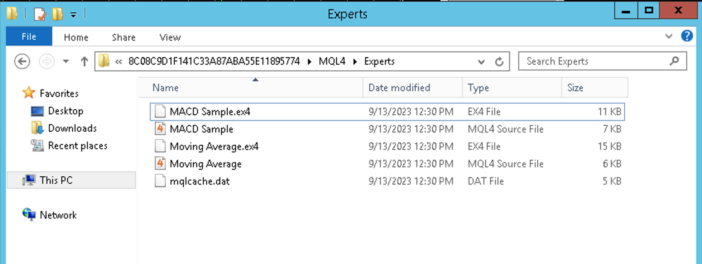

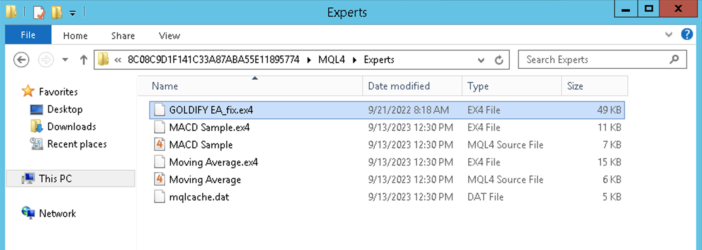

- To install a trading robot, go to the “File” menu, then “Open Data Folder.” A folder will then open. Next, you need to enter the MQL4 folder, then “Experts.”

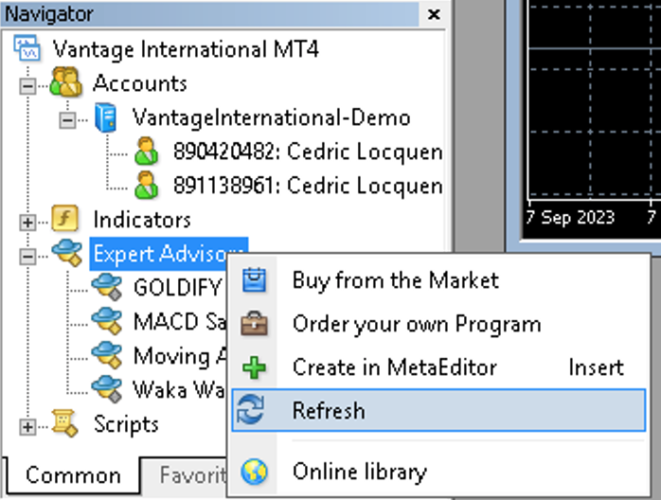

This is where you'll need to drag the file(s) for the trading robot you've chosen. There may sometimes be other specific files, so be sure to read the documentation for the robot in question. Here, for example, I'm dragging the Goldify_EA robot: You can then close this window. Back in MT4, right-click on the “Expert Advisor” line in box 5, then “Refresh” to update the list of robots. Your trading robot should then appear in the list. The installation is complete! Now comes the most important part: configuring the bot! Configuring the Trading Robot The previous installation only needs to be done once. But we still need to properly configure the trading robot.Here I'll take the example of Goldify, which is actually the bot Acwin used in its early days. Be careful, though: just because you have the same bot as another person or company doesn't mean you'll get the same results. Its settings are indeed very important.

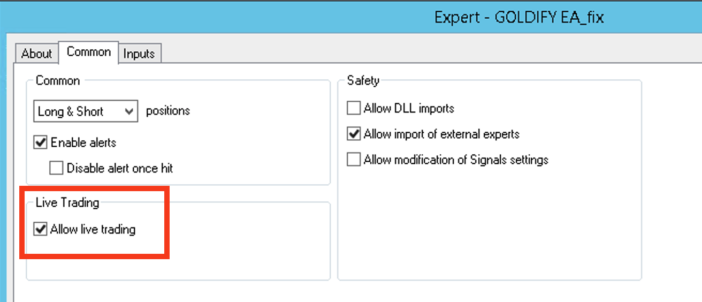

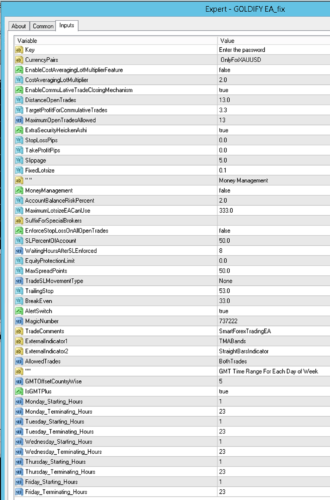

Once the window is open, select the trading robot you're interested in from the list in box 5 and drag it with the mouse onto the chart. A window will open with the robot's settings. First, go to the “Common” tab and check “Allow Live Trading.” If this box is not checked, you can adjust any parameters you want; the robot will not work. This is a small oversight that often comes up among beginners ;-) Now you can return to the “Inputs” tab to display the robot's parameters. These parameters will vary and be more or less complete from one robot to another. On Goldify, the parameters are very succinct, for example: The entire lower section already concerns the days and times authorized for trading. If you don't want to trade on Monday mornings, for example (which are often busy), you can set “Monday Starting Hours” to 12 to start only at noon.

Among the other parameters of this bot, there are really only three that are truly useful:

OpenTradeDistance: This is the distance to respect between two trades, to prevent the robot from making too many trades in a row, which can be dangerous when gold is experiencing a sharp rise.

TargetProfitForCumulativeTrades: This is the take profit; here, we indicate the profit at which the robot should close trades.

MaximumOpenTrade: The maximum number of trades to open. Because if it opens too many trades in a row, the robot can reach the account limit and lose everything.

This bot also works well on an M5 timeframe. This is important! An example of commonly used settings on this bot, for a capital of €1,000: Lot: 0.02 Target Profit for Accumulator: 10

Open Trade Distance: 200

Maximum Open Trade: 13

Everyone adjusts, of course, according to their capital, their desires, and their risk appetite.

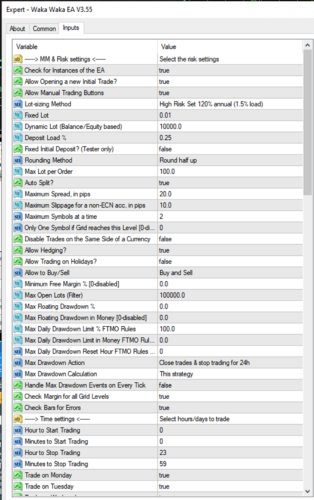

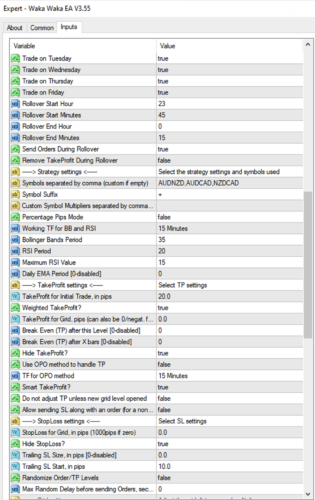

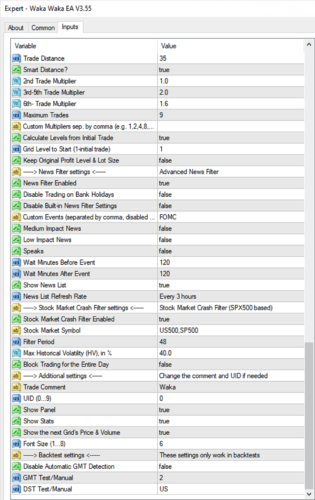

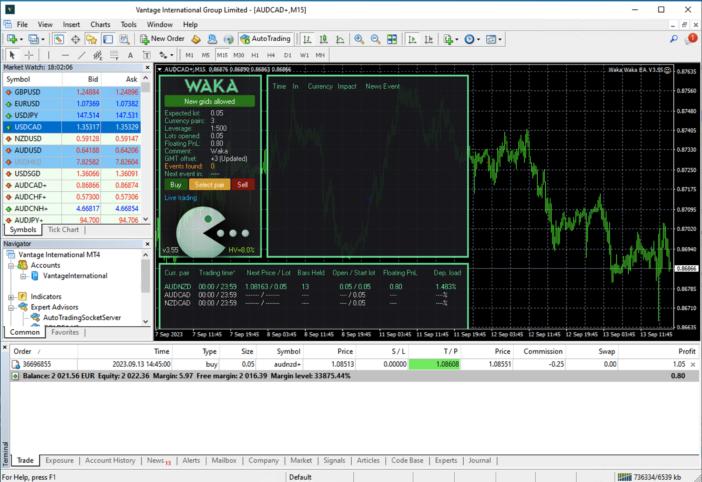

For comparison, another robot, WakaWaka, offers many more parameters. Here, reading the user manual is not an option! But this robot is much more powerful, since it is able to automatically manage announcements: here, for example, in the event of a major economic announcement from the US, the robot automatically pauses 2 hours beforehand. And will not resume until 2 hours afterward. Indeed, all economic announcements are published on an online calendar. It is also able to analyze market volatility to judge whether it is appropriate to enter it or not.

Once the parameters are finalized, confirm with the OK button. Depending on the trading bot, the display may vary. Goldify's display is very light. However, there should be a small smiley face in the upper right corner. If this isn't the case, check that the “AutoTrading” button is enabled, as well as the “Allow Live Trading” checkbox in the bot's options.

WakaWaka also features this smiley face. But the robot displays a lot of other information once launched, such as upcoming announcements, volatility, etc.

From there, the trading robot will take trades when it deems necessary. It will work completely automatically to make you money!

Be careful, however, while some trading robots can be very efficient, like Valery's, they don't perform miracles and depend heavily on the parameters entered and the market, which can sometimes be very violent. Unfortunately, I can't give you universal “miracle” parameters that work everywhere: the parameters will need to be adjusted depending on the robot, the trading pair, and your risk-adjustment and profit ambitions. Therefore, the best thing to do is to test them yourself!

To verify your parameters over time, if you don't want to wait too long, you can perform a “back test,” i.e., run a simulation over the previous x years to see how the robot would have reacted. This may give an idea of performance, but it is in no way a promise of future earnings: firstly, because past profits are no guarantee of future profits; secondly, because some developers program their bots to achieve excellent backtesting results (yes, they cheat…). Therefore, it's best to test for a few weeks or months on a demo account to verify how the bot works in real-life situations. And once the settings are validated, run it on a real account.

Since backtesting is a vast subject, I'll leave you with a very interesting video from an expert in the field, who explains it very well (don't hesitate to check out his other videos if you're interested in trading; his videos are fascinating!):

Tips and Advice

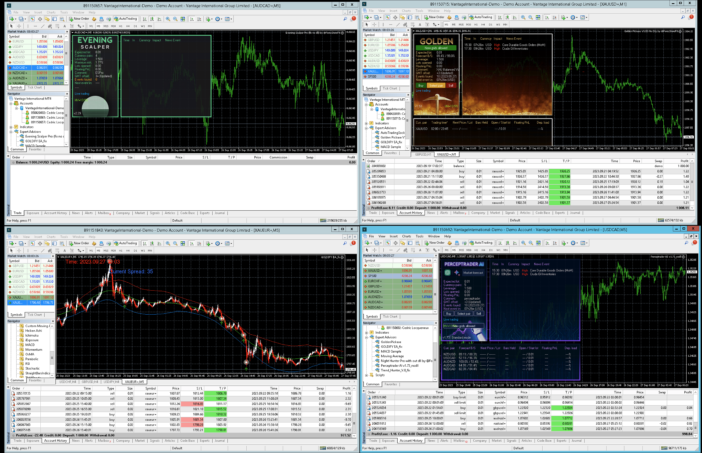

Testing a trading robot can take a long time before you can actually put it into production with a real capital base. Fortunately, it's possible to run several robots simultaneously. Be careful, however, because Metatrader 4 isn't capable of running multiple robots on different accounts (but multiple robots on the same account can). To have a different Metatrader per account and test robot, simply install the Metatrader 4 application multiple times, specifying a different installation path each time. This setting appears when you click on “Settings” on the first installation screen:

For example, on my Contabo VPS, I have four MT4s running simultaneously. These can be test robots or production robots. To diversify, it's indeed interesting to run different robots, on different pairs, and even on different brokers (here we can see VantageFX, Roboforex, and VTMarket!).

Beware of free or “cracked” robots. They can sometimes be very good. But other times they contain code that can do anything to your trading account. So be wary if the robot comes from a shady site! For example, Valery's cracked bots can be found almost everywhere. Of course, his bots are expensive, and it takes time to recoup their cost. But it's even better to get several people together to buy one (10 people at $200 each, for example, which is much more reasonable), which will allow you to benefit from support and regular updates. Because a trading bot evolves regularly, along with the market. Buying a cracked robot means forgetting about support and updates.

Don't be too aggressive when trading: big profits are the stuff of dreams, but these are often the strategies that burn out your account the quickest. It is better to make 5 to 10% quietly over the month, which is already great, and last for years, than to make 40% over the month and burn everything in two months. Trading is a marathon, not a sprint!

Stay humble: the market will always win. Those who think they are stronger than him generally find themselves on the street.

With such falls in 4 hours, many break their teeth…

If your robot does not natively manage ads, keep informed! Trading gold for example during a US announcement on the 1st Friday of the month is just suicide! The MyFXBook site offers, for example, a

calendar of economic announcements

: Basically, avoid trading during all announcements marked in red “High”. Personally I stop trading 2 hours before and I don't start again until 2 hours later. And again, depending on the state of the market. Of course this calendar should be filtered according to the pairs you are trading: on the XAUUSD, for example all US High announcements should be avoided. If you trade on the German DAX40 index, the US announcements will not be important, but we will pay attention to the European announcements.

With experience, there are times when you avoid trading. The 1st Friday of the month, for example, is NFP day, often very dangerous on everything related to the dollar. Same with the “

4 witches

- “: a day each quarter when many contracts expire.

- Monday mornings can also be dangerous, but it's also a time when volatility can allow for nice profits early in the week. Personally, I avoid Friday afternoons, which are often dangerous, as they can leave trades open all weekend, generating additional costs on transactions (known as overweek trading, as the broker is paid on open trades, which can therefore reduce the profitability of these transactions).

- If you only have a very small amount of capital to bet, it's possible to open a cent account. To my knowledge, I've only seen Roboforex offer such accounts, called “Procent.” They allow you to trade with microlots. For example, speculating on gold with €100 and lots at 0.01 would still be very dangerous. On the other hand, lots at 0.1 on a capital of 10,000 (cents, or €100) is quite possible. Be sure to use the “aefv” affiliate code when creating your account, which allows you to work with micro lots. Otherwise, the ProCent account will only allow you to work with standard lots, which are still too high for a capital of €100. As always, only invest money you are willing to lose and that you don't need to live!

- Conclusion

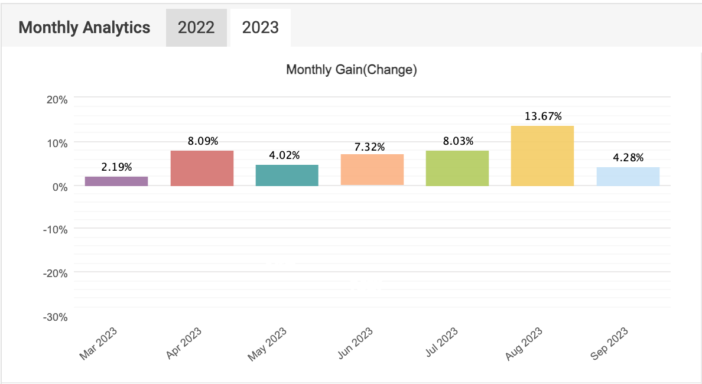

Trading is an exciting world, and one of the only investments today that allows you to make money despite a catastrophic economic situation. Indeed, trading makes no effort to avoid good economic health, since it allows you to speculate on both the rise and the fall. In both cases, it is possible to make profits. However, beware of the dream sellers you see on social media. 90% of traders lose money because they are not trained (or poorly trained), do not have the mentality to follow strict money management, or have an oversized ego that makes them believe they are stronger than the market. This is why I really like trading robots: they have no qualms, analyze the market coolly, and scrupulously respect the orders you give them. You just need to know how to choose a powerful robot and configure it correctly, without looking for mind-blowing profits. Here's an example: the WakaWaka robot, which I really like and which I've been running on a real account since the beginning of the year, without even having to worry about shutting it down during economic announcements:

While several copy traders from so-called “professionals” with 30 years of experience blew their accounts in August, it was during this period that this bot made the biggest profits, with very little risk. And all in fully automatic mode!

- Now it's your turn! And if you discover an interesting robot, don't hesitate to tell me about it in the comments; I'm always on the lookout for new, high-performance robots ;-) The same goes for if you want to make a group purchase of robots; it's entirely possible!

Please remain courteous: a hello and a thank you cost nothing! We're here to exchange ideas in a constructive way. Trolls will be deleted.